Architectural Billings Index

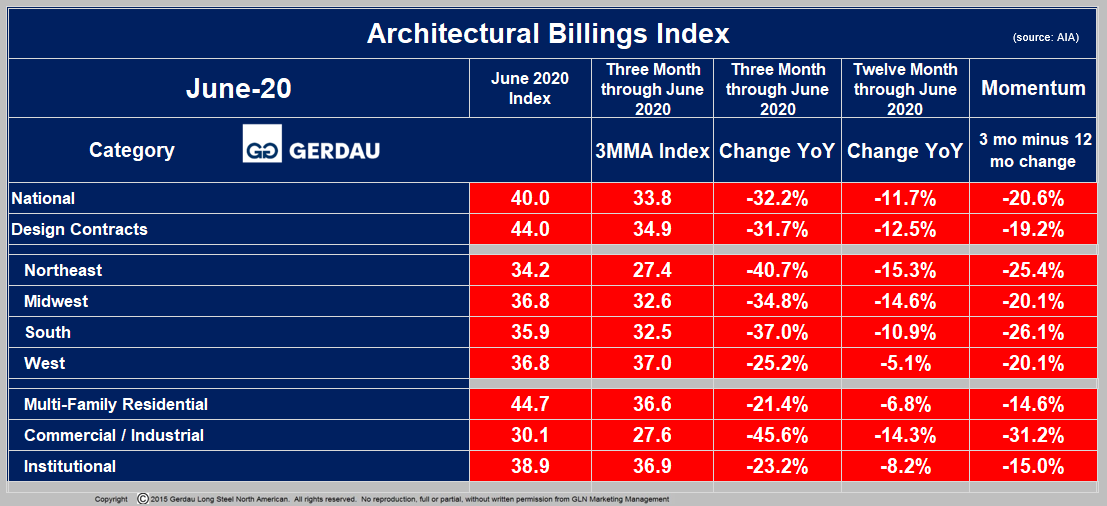

Architectural Billings Index: June ABI national overall score of 40.0 was up 8.0 points from May’s 32.0, which is under the expansionary zone, (>50). U.S. architecture firms specializing in commercial and industrial facilities likewise reported an increase design activity in June, coming on the heels of a significant upturn in May. Firms concentrating in the multifamily either residential or institutional sector reported gains in June.

The new design contracts index increased by 10.9 points to 44.0. Regional monthly scores were South 35.9, West 36.8, Midwest 36.8 and Northeast 34.2.

The Architecture Billings Index (ABI), is a leading economic indicator that provides an approximately nine to twelve-month glimpse into the future of nonresidential construction spending activity. The results are seasonally adjusted to allow for comparison to prior months. Scores above 50 indicate an aggregate increase in billings, and scores below 50 indicating a decline.

Figure 1 lists the overall ABI and all its sub-indexes. It presents and compares monthly and 3MMA data, showing percentage point change on both three and 12-month basis, as well as momentum. Green denotes positive change, while red indicates negative growth. National momentum, (3-month y/y subtract 12-month y/y) was negative 20.6% while Design contract momentum was negative 19.2%. Regionally, All zones posted negative momentum ranging from 16.9% in the Midwest to 23.5% in the South. Multi-family residential, Commercial / Industrial and Institutional all recorded negative momentum.

At Gerdau we follow the ABI because it is a leading indicator of non-residential construction activity with an approximate 12-month lead-time to ground-breaking. The ABI has a proven track record and as such it is useful for business planning purposes.