Automotive Sales

Total light vehicle, (LV) sales in February were at an annual rate, of 17.861 M units, up 0.512 million (M) from January, but down 0.185 M year on year (y/y). Light truck sales continue see solid growth, selling at an annualized rate of 11.589 M in February, up 0.561 M units m/m and up 0.705 M units y/y. Over the same time frame, annualized car sales sold 4.910 M units, down 0.135 m/m and off 0.539 y/y.

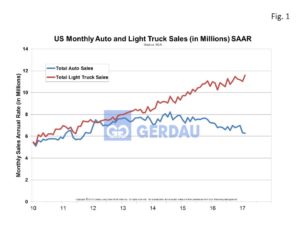

Figure 1 compares US sales of cars and light trucks on the same chart. Truck sales are trending up while car sales are trending downward. On a 3 month moving average (3MMA) basis y/y through February, LV sales of domestically produced autos fell 9.9% as imports increased by 8.2%, 3MMA y/y. Import market-share for cars averaged 26.4% over the last 12 months but increased over the last three months averaging

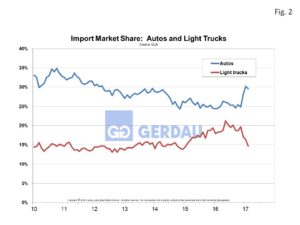

Figure 1 compares US sales of cars and light trucks on the same chart. Truck sales are trending up while car sales are trending downward. On a 3 month moving average (3MMA) basis y/y through February, LV sales of domestically produced autos fell 9.9% as imports increased by 8.2%, 3MMA y/y. Import market-share for cars averaged 26.4% over the last 12 months but increased over the last three months averaging 29.3% through February. Domestically produced light trucks rose by 8.9%, 3MMA y/y. Import market-share for light trucks averaged 18.6% over the last 12 months, but has been declining over the last three months averaging 16.1%% through February, (Figure 2).

29.3% through February. Domestically produced light trucks rose by 8.9%, 3MMA y/y. Import market-share for light trucks averaged 18.6% over the last 12 months, but has been declining over the last three months averaging 16.1%% through February, (Figure 2).

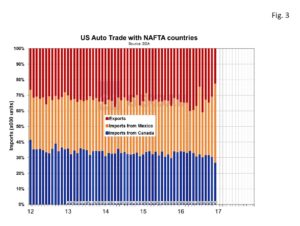

Figure 3 examines auto trade within the NAFTA countries on a chart with percentage of total (or base 100), as the Y axis. Imports from Mexico are increasing at the expense of Canadian imports and US exports. Over the past three months Mexican imports averaged 41.0% of the total, Canadian imports 29.9% and US exports 29.1%, (41.0 +29.9 + 29.1 =100). One year ago these values were: Mexican imports, 32.3% Canadian imports, 34.0%, US exports 33.7%, (32.3+ 34.0 + 33.7 = 100). This is a significant change over a short timeframe and a daunting trend should it continue.

Figure 3 examines auto trade within the NAFTA countries on a chart with percentage of total (or base 100), as the Y axis. Imports from Mexico are increasing at the expense of Canadian imports and US exports. Over the past three months Mexican imports averaged 41.0% of the total, Canadian imports 29.9% and US exports 29.1%, (41.0 +29.9 + 29.1 =100). One year ago these values were: Mexican imports, 32.3% Canadian imports, 34.0%, US exports 33.7%, (32.3+ 34.0 + 33.7 = 100). This is a significant change over a short timeframe and a daunting trend should it continue.

Ward’s Automotive reported that total light vehicle inventories in the US were 72 days at the end of March, down from 74 in February but up from 66 days in March last year. The big three domestic suppliers, GM Ford and FCA inventories were: 98, 79 and 83 days respectfully. Import brand names, Toyota, Honda and Nissan days’ supply were lower: 61, 76 and 61. BMW had the lowest days on hand at 34, Volkswagen had the highest at 105.

At Gerdau, we monitor production and sales of light, medium and heavy vehicles since they consume a tremendous amount of engineered steel. In addition, the health of the automotive industry offers an important gauge on the overall strength of the US economy.