Automotive Sales

Data from the Bureau of Economic Analysis (BEA), shows that total light (cars and light truck/SUVs), vehicle sales in June were at an annual rate, of 16.810 million (M), units, down 182,000 units or 1.1% from May. On a three month moving average (3MMA), basis, sales were 17.003M, down 0.2% month on month (m/m) and off 2.7% year on year (y/y).

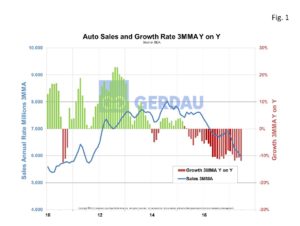

Figure 1 shows the history of car sales (domestic plus imports), from 2010 to present. June sales declined by 278,000 units or down 4.7%. Sales were down 11.9% 3MMA y/y and have been declining for 25 months on a 3MMA y/y metric.

Figure 1 shows the history of car sales (domestic plus imports), from 2010 to present. June sales declined by 278,000 units or down 4.7%. Sales were down 11.9% 3MMA y/y and have been declining for 25 months on a 3MMA y/y metric.

In June, domestic car sales fell 232,000 units or -5.0%, m/m. On a 3MMA domestic car sales were down 7.9% y/y. Import sales dipped by 42,000 units or -3.1%, m/m. On a 3MMA import car sales were down 23.3% y/y. Import market share for cars stands at 23.0%, down 1.7% from the previous 12 month average.

Figure 2 shows light truck (domestic plus imports), sales history from 2010 to present.

shows light truck (domestic plus imports), sales history from 2010 to present.

Light truck sales were up 96,000 units or 0.9% m/m. Domestically produced light truck sales were up 187,000 units or 2.3% in June as imported light truck sales fell by 86,000 units or -3.6%. Import market share for light trucks stands at 20.8%, down 1.1% from the previous 12 month average.

Figure 3 charts import market-share of cars and light trucks from 2010 to present. Car market-share is trending down, falling from the mid-thirties in 2010 & 2011 to its current 23.3%. Light truck import market-share is showing just the opposite trend, rising from around 15% from 2010 through 2015 to its current 20.8%.

Figure 3 charts import market-share of cars and light trucks from 2010 to present. Car market-share is trending down, falling from the mid-thirties in 2010 & 2011 to its current 23.3%. Light truck import market-share is showing just the opposite trend, rising from around 15% from 2010 through 2015 to its current 20.8%.

June sales figures for the major producers were as follows: GM, -4.7%, Ford, -5%, Fiat Chrysler, -7.4%, Toyota, +2.1%, Nissan +2%, Mazda, -14.7%, Subaru, +11.7%. June U.S light vehicle days’ supply was 74 days, up 8 days y/y.

Auto manufacturers are expected to use this year's retooling period to reduce bloated inventories. According to Wards, manufacturers have been reducing planned production for the third quarter with a notable decline in output planned for July. Motor vehicle and parts production will also be impacted, as will the broader manufacturing sector. There is a strong correlation (0.73), between seasonally adjusted changes in motor vehicle part production and total manufacturing output in July. This will play havoc with some of the near future macro-economic numbers like initial claims for unemployment insurance, hours worked. On a positive note consumer confidence and spending levels continue to be strong.

At Gerdau, we monitor production and sales of light, medium and heavy vehicles since they consume a tremendous amount of engineered steel. In addition, the health of the automotive industry offers an important gauge on the overall strength of the US economy.