Chicago Fed National Activity Index

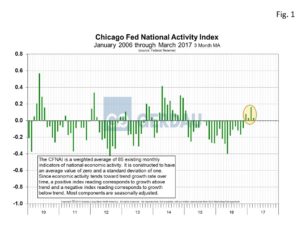

The CFNAI stayed on the positive side in March scoring a 0.08, down from the strong 0.34 recorded in February. This CFNAI three month moving average (3MMA) dropped to 0.03 from 0.16 in the previous month. Weakness in employment related indicators was the primary cause.

The Chicago Fed National Activity Index is a coincident indicator of broad economic activity. It is released monthly by the Chicago Reserve Board. The index value is set such that a value of 0 indicates that the economy is growing at its long-run potential. A value above 0 indicates that the economy is growing above potential, while a negative value indicates that the economy is growing below its potential. The index is a weighted average of 85 indicators of national economic activity.

Figure 1 shows the CFNAI 3MMA from 2010 to present. The index has been positive for four consecutive months which means the economy is expanding at above trend. This is very promising news on the heels of a string of 22 consecutive months of contraction.

Figure 1 shows the CFNAI 3MMA from 2010 to present. The index has been positive for four consecutive months which means the economy is expanding at above trend. This is very promising news on the heels of a string of 22 consecutive months of contraction.

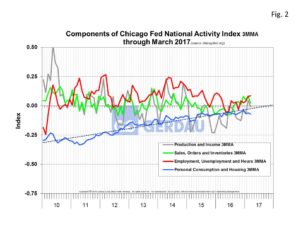

There are four sub-indexes in the overall CFNAI, including: Production and Income, Employment, Unemployment and Hours, Sales Order and Inventory and Personal Consumption and Housing. In March’s report, three of the four were positive contributors to the overall index. Personal Consumption and Housing was the lone negative contributor at -0.05. This sub-index of the overall CFNAI has been in the negative column for 118 consecutive (blue line), months going all the way back to June 2007,  (Figure 2). The good news is that Personal consumption and housing has been steadily trending higher and if it continues on the current trajectory will turn positive in November of this year. On a 3MMA Production and Income, Employment scored -0.07, Production and Income was slightly negative at -0.01, Sales Order and Inventory recorded a +0.07 and Employment, Unemployment and Hours posted a 0.02 which was a large drop from Februarys’ 0.20.

(Figure 2). The good news is that Personal consumption and housing has been steadily trending higher and if it continues on the current trajectory will turn positive in November of this year. On a 3MMA Production and Income, Employment scored -0.07, Production and Income was slightly negative at -0.01, Sales Order and Inventory recorded a +0.07 and Employment, Unemployment and Hours posted a 0.02 which was a large drop from Februarys’ 0.20.

The big change month on month was in the employment numbers. February’s saw 219,000 job creation, while March’s number fell back to 98,000. These numbers can be volatile from month to month which is why at Gerdau we prefer to examine most data series on a 3MMA which smooths-out the unevenness in most cases. The Employment, Unemployment and Hours sub-index had not made a negative contribution since last August, so as such has been a reliable positive contributor to the overall index. Residential construction showed a little weakness for both single family and multi-family starts month over month. This was largely blamed on weather related issues particularly on the east coast. This is seen as a temporary stumble not a softening market. In fact the trend in housing starts is gaining momentum as starts moved up to 1.25 million in March, its strongest showing since 2007.

At Gerdau we follow the CFNAI on a monthly basis since it is one of the broadest measures of the health of the US economy. A healthy and expanding US general economy correlates well to stronger steel consumption.