Chicago Fed National Activity Index

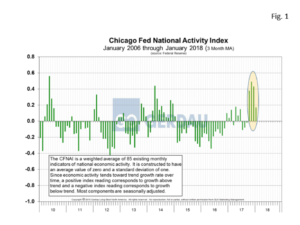

The pace of U.S. economic growth moved sideways in January as the CFNAI ticked down +0.12 from a +0.14 score in December. On a three month moving average, (3MMA) basis the CFNAI fell-back to +0.17. This was the fifth consecutive month of positive readings on a 3MMA basis, the first time since 2014 that a string of five positive readings has occurred.

The Chicago Fed National Activity Index is a coincident indicator of broad economic activity. The index is a weighted average of 85 indicators of national economic activity. A zero value for the CFNAI has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

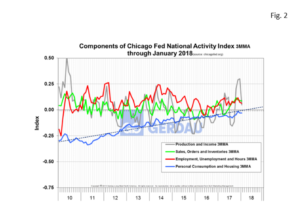

On a monthly basis, two of the four sub-indexes were positive in January. The Production and Income sub-index posted a -0.01. Employment, unemployment and Hours scored a +0.09. Sales Orders and Inventory edged higher by +0.07. Personal Consumption and Housing sub-index recorded a -0.03.

Figure 1 shows the 3MMA of the CFNAI from 2010 to present. The CFNAI has now been in positive territory for eight of the last 12 months through January. The Personal Consumption and Housing sub-index continues to drag the overall index down. Note that the last four months, (highlighted bubble) exhibit the strongest performance since the second quarter of 2014.

Figure 1 shows the 3MMA of the CFNAI from 2010 to present. The CFNAI has now been in positive territory for eight of the last 12 months through January. The Personal Consumption and Housing sub-index continues to drag the overall index down. Note that the last four months, (highlighted bubble) exhibit the strongest performance since the second quarter of 2014.

Figure 2 shows the four sub-indexes of the overall CFNAI on a 3MMA basis. On a 3MMA evaluation, the Production and Income sub-index posted a +0.05. Production and Income has recorded four consecutive monthly gains, (0.21, 0.29. 0.30 and 0.05). Employment, unemployment and Hours scored a +0.06. This sub-index has been in positive territory on 3MMA basis for 15 months. Â Â Sales Orders and Inventory moved higher by +0.09, making a string of eight months of gains. Personal Consumption and Housing sub-index recorded a -0.03. The personal housing and consumption category continued its streak, now at 132 months of negative contributions to the CFNAI going back all the way back to May 2007.

shows the four sub-indexes of the overall CFNAI on a 3MMA basis. On a 3MMA evaluation, the Production and Income sub-index posted a +0.05. Production and Income has recorded four consecutive monthly gains, (0.21, 0.29. 0.30 and 0.05). Employment, unemployment and Hours scored a +0.06. This sub-index has been in positive territory on 3MMA basis for 15 months. Â Â Sales Orders and Inventory moved higher by +0.09, making a string of eight months of gains. Personal Consumption and Housing sub-index recorded a -0.03. The personal housing and consumption category continued its streak, now at 132 months of negative contributions to the CFNAI going back all the way back to May 2007.

Manufacturing is off to a good start in 2018, helped by a strong global economy and a depreciated U.S. dollar. Payrolls in January swelled by 200,000, more than twice the number needed to sustain the growing work age population. The labor market is now entering its ninth year of growth, an unprecedented achievement. A tighter labor situation is driven wages higher. Year on year hourly rates have increased by 2.9%, the greatest increase since the expansion started.

Overall Januarys CFNAI was an encouraging report.

At Gerdau we follow the CFNAI on a monthly basis since it is one of the broadest measures of the health of the US economy. A healthy and expanding US general economy correlates well to stronger steel consumption.