China Domestic Prices

China Domestic Prices: China Metals Weekly (CMW), September 28th newsletter reported that for the third week in a row, long products prices fell across the board on a week over week basis from. On a month over month (m/m), basis long products increased for all angles and channels but were down for wire rod, beams and rebar. Angles advanced 0.7% m/m to $591 per ton, channels moved-up 0.2% m/m to $582. Beams fell 1.7% m/m to $564. Wire rod priced was off 1.0% m/m to $562 per ton and rebar was down $23 to $527 per ton, a 3.6% m/m decrease. Hot rolled coil (HRC) prices continued to slid, plummeting an additional 7.6% m/m to $394 per ton. Hot rolled coil prices have fallen a combined $32 per ton, down in each of the last five weeks.

Examining prices compared to one year ago shows that long products were higher in every sub-category ranging from 52% to 76% or from $215 to $237 per ton. Over the same timeframe. HRC increased by only $6 per ton

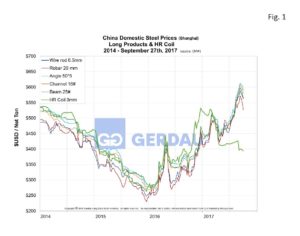

Figure 1 shows the price history per net ton for longs and HRC from 2014 to present. Long product pricing is surging higher while HRC is trending lower. Figure 2 shows the price history per net ton for structural steel.

Figure 1 shows the price history per net ton for longs and HRC from 2014 to present. Long product pricing is surging higher while HRC is trending lower. Figure 2 shows the price history per net ton for structural steel.

China Customs reports that the exports of Chinese scrap was 411,200t in August, up by 141% m/m, and a mammoth increase compared to the 79t in August of 2016. During January through August, total export of scrap was 879,700t. Most of the scrap exports was shred which is not consumed in large quantities domestically. This is because the vast majority of Chinese steel plants are blast furnace/ basic oxygen plants. Shredded scrap is a major feed-stock for electric furnaces which are widely used in other parts of the world, to include the U.S. The vast majority of this scrap was exported to countries in the Pacific Rim including: Thailand, Indonesia, Taiwan, Vietnam, Hong Kong and India. The large increase in shredded scrap exports is expected to continue in September.

Referencing CMW, year to date, (YTD) profit of industrial enterprises grew by 21.6% y/y to RMB4.921 trillion, (approximately US$ $673 billion) according to National Bureau of Statistics. Several Chinese steel mills are now profitable, one example is Anyang Steel which anticipates a profit of RMB900M, (US$123 million) for the nine months ending September. This represents a 540% y/y increase compared to the same period in 2016. Anyang cites the decision to reduce capacity to optimize supply/demand in the domestic market with its improved performance.

Shipbuilding output grew by 41.1% YTD y/y as China completed 31.32 million DWT (deadweight tons). New orders for shipbuilding totaled 15.85 million DWT, down 11.3% y/y. At the end of August the order back-log was 81.1 million DWT, down 29% y/y. Ninety four percent of the completed ships were for export orders.

Billet prices were under pressure in many parts of China as inventory was up and re-rolling mills stopped production. Billet prices fell by $22 to $25 per ton to between $495 and $512 per ton. Pig iron on the other hand was relatively stable. Prices for steelmaking pig iron ranged from $370 to $390 per ton. Meanwhile, casting pig iron sold for $458 per ton. Iron ore prices were depressed in most regions last week as steel mills in Northern China were forced to cut production for environmental reasons. Prices fell $1 to $5 per ton, reaching $91 to $94 per ton for 66% dry concentrated iron. Further price erosion is expected in the near term.

At Gerdau we keep a keen-eye on Chinese steel production and pricing. China produces close 50% of the world’s steel and as a result has a massive influence on global steel trade patterns. Imported steel volume and pricing has an influence on domestic steel so we routinely monitor it.