Employment Jobless Claims

New filings for unemployment insurance benefits moved up 20,000 to 243,000 for the week ending March 4th, while the four week moving average was 236,500. Continuing unemployment claims fell 6,000 to 2,058,000 for the week ending February 25th as the net number of unemployed people collecting benefits remained at 1.5% where is has been for 16 weeks.

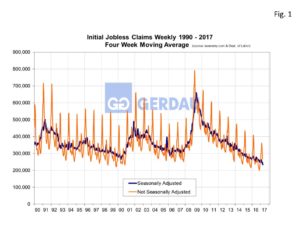

Figure 1 presents a long-term (1990 to present), view of continuing claims for unemployment insurance benefits. It reveals that we are now at the lowest level since May 2000 when the rate reached a low of 1,987,000. Figure 2 charts the same data from 2009 to present but includes color coding which depicts where we are on the economic spectrum. We are now solidly in the “green zone” which means sustained economic growth according to the Department of Labor.

Figure 1 presents a long-term (1990 to present), view of continuing claims for unemployment insurance benefits. It reveals that we are now at the lowest level since May 2000 when the rate reached a low of 1,987,000. Figure 2 charts the same data from 2009 to present but includes color coding which depicts where we are on the economic spectrum. We are now solidly in the “green zone” which means sustained economic growth according to the Department of Labor.

New filings for benefits have remained below 300,000 for 105 weeks which is a bullish sign for the labor market. Moody’s Analytics expects that private sector job increases will average 180,000 per month in 2017. The public sector is expected to contribute an additional few thousand per month. Strong consumer confidence, reduced government regulation, lower taxes, rising business confidence and a booming stock-market combine to keep pressure on the labor market. Many employers are reporting difficulty finding workers with the needed skill sets as open positions approach record high levels. This will result in wage hikes which in-turn will promote more spending and further strengthen the economy.

At Gerdau, we keep a keen eye on the employment numbers because we have demonstrated that there is an excellent correlation between employment levels and steel consumption. High job creation and low unemployment translate to strong steel demand and vice versa.