Federal Senior Loan Officer Survey

For the second quarter in a row lenders have relaxed standards for Commercial and Industrial loans to large and medium sized firms. Banks have however, tightened standards for Commercial Real Estate loans. Demand for these types of loans has reportedly waned. Credit has eased across the board for residential mortgages, while credit card auto loans have been reined-in. Demand for consumer loans was down for the third consecutive quarter.

This voluntary survey is conducted with a senior loan officer at each respondent bank. Senior financial officer staff at the reserve banks with knowledge of bank lending practices administer the interview. The reporting panel consists of up to 60 large, domestically chartered commercial banks and up to 24 large U.S. branches and agencies of foreign banks. The purpose of the survey is to provide qualitative and limited quantitative information on credit availability and demand, as well as evolving developments and lending practices in the U.S. loan markets.

Commercial and industrial loans (C&I is any type of loan made to a business or corporation in order to provide either working capital or to finance major capital expenditures), saw loans lending standards ease in Q3-2017, (Figure 1). The percentage of banks reporting unchanged lending standards was 96.1%, while 3.9% indicated that they eased somewhat. Banks cite greater competition as well as a healthier future outlook for the improved risk appetite. For small businesses, 4.1% of surveyed banks relaxed lending practices, 93.2% were unchanged lending standards was while the remainder reported that they had tightened somewhat.

The percentage of banks reporting unchanged lending standards was 96.1%, while 3.9% indicated that they eased somewhat. Banks cite greater competition as well as a healthier future outlook for the improved risk appetite. For small businesses, 4.1% of surveyed banks relaxed lending practices, 93.2% were unchanged lending standards was while the remainder reported that they had tightened somewhat.

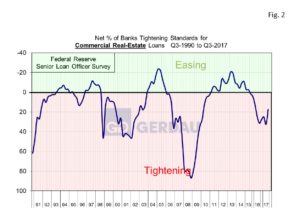

Figure 2  shows that commercial real estate loans lending continued to tighten. Lending standards began tightening in Q3-2015 and have continued to tighten with each passing quarter. A net 9.3% of banks reported tighter lending standards for nonfarm nonresidential loans in Q2, while 18.4% of banks said they were tightening standards for multi-family loans. Lenders also reported that 17.3% tightened lending standards for construction and land development loans. Demand for commercial real estate loans was weaker across the board in the second quarter. Delinquencies have moved steadily higher over the past several quarters, particularly in the retail and office segments. Internet shopping continues to grow at the expense of brick and mortar stores and now make up nearly 10% of all non-auto retail purchases. This trend is expected to continue.

shows that commercial real estate loans lending continued to tighten. Lending standards began tightening in Q3-2015 and have continued to tighten with each passing quarter. A net 9.3% of banks reported tighter lending standards for nonfarm nonresidential loans in Q2, while 18.4% of banks said they were tightening standards for multi-family loans. Lenders also reported that 17.3% tightened lending standards for construction and land development loans. Demand for commercial real estate loans was weaker across the board in the second quarter. Delinquencies have moved steadily higher over the past several quarters, particularly in the retail and office segments. Internet shopping continues to grow at the expense of brick and mortar stores and now make up nearly 10% of all non-auto retail purchases. This trend is expected to continue.

Demand for residential mortgage loans improved. Outstanding balances were up by $17.8 billion in June to total $8.32 trillion. Mortgage loans default rates continue to decline making these loans more desirable than auto and other consumer loans which are seeing higher delinquency rates. Auto loan default rates have increased to 2.5%, double the broader market rate and is a major concern going forward as most of the pent-up demand for new vehicles has been satisfied. Consumer credit lending standards were tightened for the fifth month in a row in Q2 as 7.7% of banks reported tighter lending standards for auto loans. For credit cards, 5.8% of respondents reported tighter lending standards.

Strong job creation, wage gains and strong balance sheets have combined to expand lending over the past couple of years. The current overall macro-economic metrics point to this trend continuing.

At Gerdau, we keep a keen eye on the Federal Senior Loan Officer Survey because it offers insight into the future demand for steel products. If demand is increasing and capital is widely availability, future steel sales will be robust. Of course the opposite is true if demand is waning and capital availability is difficult to come by.