US Steel Mill Shipments and Domestic Consumption of Long Products

For the 12 months ending June 2017, US mill shipments of long products fell 660,000 tons or 2.9%. US domestic consumption of long products fell 464,000 tons or 1.7% over the same timeframe. Import share of long products averaged 23.9% over the past 12 months, up 1.0% year on year, (y/y).

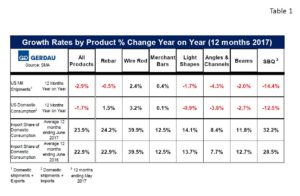

Table 1 presents data for long product steel shipments from mills defined as domestic shipments plus exports as well as apparent domestic consumption, defined as domestic shipments plus imports. There was considerable variation by product group.

Table 1 presents data for long product steel shipments from mills defined as domestic shipments plus exports as well as apparent domestic consumption, defined as domestic shipments plus imports. There was considerable variation by product group.

Mill shipments increased for wire rod (+2.4% y/y) and merchant bars (+0.4% y/y). Rebar, light shapes, angle & channel, beams and SBQ mill shipments all declined y/y. SBQ mill shipments had the largest decline, off 14.4% y/y. Angle & channel mill shipments fell 4.3% y/y, beams fell 2.0%, light shapes were down 1.7% and rebar was off by 0.5%.

Domestic consumption of long products rose for rebar (+1.5% y/y), wire rod (+3.2% y/y) and merchant bars (+0.1% y/y). Light shapes, angle & channel, beams and SBQ domestic consumption all declined y/y. SBQ domestic consumption recorded the largest drop, falling 12.5% y/y. Angle & channel domestic consumption fell 3.8% y/y, beams 2.7% y/y and by light shapes were down by 0.9% y/y.

Domestic consumption was impacted by a soft manufacturing environment (other than strong automobile sales which are now starting to soften), which struggled combatting a strong dollar which invites imports and imparts headwinds for exporters. Despite the recent uptick, the energy sector continues to be plagued by low gas and oil prices also contributed to low steel demand for SBQ, MBQ and beams. Imports continue to be attracted to a relatively strong US dollar.

We closely monitor production, domestic consumption and imports share of long product steel because it is important for our business and our customers businesses to understand the changes taking place in the US long product marketplace.