The Baltic Dry Index

The BDI is a shipping and trade index created by the London-based Baltic Exchange that measures changes in the cost to transport raw materials.

The BDI includes three component ships: Capesizes, Panamaxes and Supramaxes. The BDI averaged 361 year to date (YTD) 2016. In 2017 YTD the index has averaged 959.

Capesize ships are the largest. The average size of a Capesize ship is 156,000 deadweight tonnage (DWT) and can range up to 400,000 DWT. Capesize ships primarily transport coal and iron ore on long-haul routes. The next smallest size is the Panamax ships have a capacity of 60,000 to 80,000 DWT. The smallest ships included in the BDI are the Supramaxes with a capacity less than 59,999 DWT. Capesizes and Panamaxes account for the vast majority of steel and its raw material freight.

The Baltic Dry Index offers a forward view into global supply and demand trends. A rising index can indicate a strengthening global economy. A contracting BDI index signals a slow-down because the goods shipped are often raw materials and lead time to produce finished goods can be extensive. Since the number of ships is limited, the index can experience high levels of volatility if global demand rises or falls over a short time frame.

The Baltic Dry Index offers a forward view into global supply and demand trends. A rising index can indicate a strengthening global economy. A contracting BDI index signals a slow-down because the goods shipped are often raw materials and lead time to produce finished goods can be extensive. Since the number of ships is limited, the index can experience high levels of volatility if global demand rises or falls over a short time frame.

Figure 1 illustrates this volatility for both Capsize and Panamax indexes. In 2008 the Capsize index spiked to over 18,000, just before the great recession ensued. Today (April 5th), the Capsize index stands at 2,229, it was just 466 on one year ago.

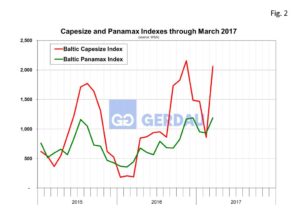

Figure 2 presents the same data as Figure 1 only shortens the time horizon to just the last 27 months. At this lessened Y axis scale we can see that both the Capsize and Panamax indexes are on the rise, an encouraging trend.

At Gerdau we regularly monitor the Baltic Dry index since it is a leading indicator of demand for goods on a global scale. An increasing BDI signals stronger global trade which can be good for domestic business if the transactions are fairly traded.