Chicago Fed National Activity Index

After recording a +0.18 reading in December, the CFNAI fell 0.05 points in January because of decreases in production-related indicators. The Chicago Fed National Activity Index is a coincident indicator of broad economic activity. It is released monthly by the Chicago Reserve Board. The index value is set such that a value of 0 indicates that the economy is growing at its long-run potential. A value above 0 indicates that the economy is growing above potential, while a negative value indicates that the economy is growing below its potential. The index is a weighted average of 85 indicators of national economic activity.

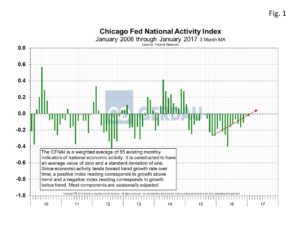

On a 3MMA basis the CFNAI has recorded negative values for 24 consecutive months, the longest stretch of negative scores since the great recession,  (Figure 1). The encouraging news is that degree of negativity is moderating (red arrow). If the trend continues the CFNAI should turn positive shortly.

(Figure 1). The encouraging news is that degree of negativity is moderating (red arrow). If the trend continues the CFNAI should turn positive shortly.

There are four sub-indexes in the overall CFNAI (Figure 2) , these include: The 3MMA Production and Income index fell to negative 0.06, and has been posting negative numbers for seven consecutive months. The 3MMA Sales Order and Inventory index eked out a gain of 0.01, up two months running. The Personal Consumption index continues to post negative readings, most recently off 0.06. Housing is a huge contributor to the personal consumption index and is still nowhere near the prerecession build-rate. Housing starts fell to 1.25 million annualized units in January from 1.28 million in November. Permits increased to 1.29 million annualized units in January from 1.23 million indicating stronger growth in the months ahead. On the bright-side, the 3MMA readings for Employment, Unemployment and Hours were positive, +0.04, up 3 months in a row as non-farm payroll rose by 227,000 in January besting December’s 157,000.

, these include: The 3MMA Production and Income index fell to negative 0.06, and has been posting negative numbers for seven consecutive months. The 3MMA Sales Order and Inventory index eked out a gain of 0.01, up two months running. The Personal Consumption index continues to post negative readings, most recently off 0.06. Housing is a huge contributor to the personal consumption index and is still nowhere near the prerecession build-rate. Housing starts fell to 1.25 million annualized units in January from 1.28 million in November. Permits increased to 1.29 million annualized units in January from 1.23 million indicating stronger growth in the months ahead. On the bright-side, the 3MMA readings for Employment, Unemployment and Hours were positive, +0.04, up 3 months in a row as non-farm payroll rose by 227,000 in January besting December’s 157,000.

The mild winter weather pulled-down the demand for oil and natural gas causing the utilities index to negatively impact the industrial production index. The milder weather will kick-start construction activity and likely extend it duration this year. Manufacturing news was generally positive, the solid score on the recent ISM manufacturing index, coupled with expectations of fewer regulations and lower corporate and personal taxes holds promise for better times ahead.

At Gerdau we follow the CFNAI on a monthly basis since it is one of the broadest measures of the health of the US economy. A healthy and expanding US general economy correlates well to stronger steel consumption.