Chicago Fed National Activity Index

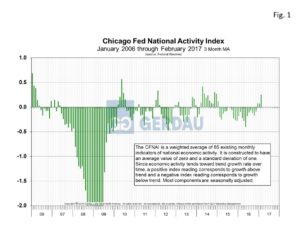

The CFNAI rebounded sharply in February rising to 0.34 from January’s disappointing -0.02. The strong rise boosted the 3 month moving average (3MMA) to 0.25 and the 6MMA to 0.07. Solid employment gains contributed 0.21 points to the index as non-farm payrolls rose by 235,000 resulting in an unemployment rate of 4.7%.

The Chicago Fed National Activity Index is a coincident indicator of broad economic activity. It is released monthly by the Chicago Reserve Board. The index value is set such that a value of 0 indicates that the economy is growing at its long-run potential. A value above 0 indicates that the economy is growing above potential, while a negative value indicates that the economy is growing below its potential. The index is a weighted average of 85 indicators of national economic activity.

Stronger business and consumer confidence, rising stock portfolios, increasing wage pressure, robust household balance sheets, and improving conditions for energy producers and manufacturers all contributed to the CFNAI’s advance in February. Recent history has been quite erratic, however on a 3MMA basis the CFNAI, (Figure 1) has been positive for three consecutive months which means the economy is expanding at above trend.

Stronger business and consumer confidence, rising stock portfolios, increasing wage pressure, robust household balance sheets, and improving conditions for energy producers and manufacturers all contributed to the CFNAI’s advance in February. Recent history has been quite erratic, however on a 3MMA basis the CFNAI, (Figure 1) has been positive for three consecutive months which means the economy is expanding at above trend.

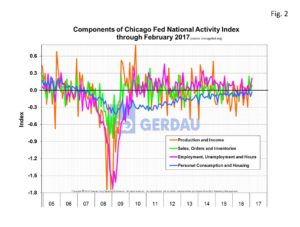

There are four sub-indexes in the overall CFNAI, including: Production and Income, Employment, Unemployment and Hours, Sales Order and Inventory and Personal Consumption and Housing. In February’s report, three of the four were positive contributors to the overall index. Personal Consumption and Housing was the lone negative contributor at -0.05. This sub-index of the overall CFNAI has been in the negative column for 117 consecutive months going all the way back to June 2007,  (Figure 2). While consumers have increasingly opened their wallets for automobiles and many other goods and services, new home construction continues to be lackluster. Housing starts rose to 1.29 million annualized units from 1.25 million in January, while permits fell to 1.21 million annualized units in February from 1.29 million. To put this into perspective, housing starts exceeded 2 million for several years running pre-recession.

(Figure 2). While consumers have increasingly opened their wallets for automobiles and many other goods and services, new home construction continues to be lackluster. Housing starts rose to 1.29 million annualized units from 1.25 million in January, while permits fell to 1.21 million annualized units in February from 1.29 million. To put this into perspective, housing starts exceeded 2 million for several years running pre-recession.

At Gerdau we follow the CFNAI on a monthly basis since it is one of the broadest measures of the health of the US economy. A healthy and expanding US general economy correlates well to stronger steel consumption.