China Domestic Prices

China Metals Weekly (CMW), reported April 13th that China exported 7.56 million tonnes (Mt) of steel products in March, an increase of 1.81 Mt over February. The good news is that this amount was down by 24.2% year on year (y/y). CMW also reported that Chinese steel imports for the first quarter were 3.48 MT, up 11.3% y/y.

Further evidence that China’s economy is on the mend, auto sales are booming. CMW reports that 2.604 million (M) autos were produced in March, up 20.6% m/m and up 3% y/y, while 2.543 M units were sold a 31.1% m/m and 4% y/y increase. For the first quarter 7.133 M units were produced and 7.002 M were sold. These values were up 8% and 7% respectfully.

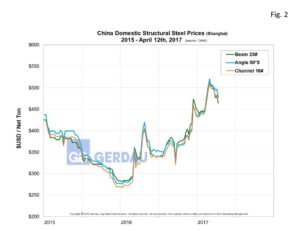

As of April 13th month on month (m/m) long product prices were down across the board. Wire rod pricing fell 9.9% m/m in dollar terms to $440 per ton, rebar was priced at $437 down 9.8% m/m. Beams (25#), slide back 8.5% to $468. Channel (16#) at $468 fell 6.4% m/m and 50x5 angle could be purchased at $477, down 5.5% compared to the same time last month. Hot rolled coil took a beating, down 15.5% m/m to $423, down m/m for the sixth month in a row.

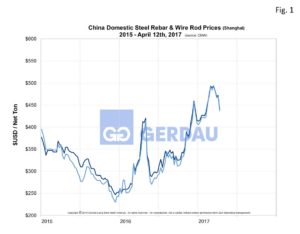

Figure 1 shows pricing history for rebar and wire rod. These two products are priced very close to one another and move in lock-step when there is a price change in the marketplace.

Figure 1 shows pricing history for rebar and wire rod. These two products are priced very close to one another and move in lock-step when there is a price change in the marketplace.

Figures 2 show pricing history for structural products. In a similar manner as rebar and wire rod, the Chinese structural products tend to follow one another very closely.

China imported 95.56 Mt of iron ore in March up 11.45 Mt. For the first quarter the number was 270.99 Mt, a 12.2% y/y increase.

Chinese billet prices have been falling in most regions of the country. CMW reports that trading activity is down at the same time blast furnace operating rates have increased. Prices are expected to fall further under this scenario. According to CMW, billet prices ranged from $387 to $423. In its long product section, CMW reports that “profitability is good” and enthusiasm within the steel companies remains high. So production is being ramped up as there is demand-side pressure for construction steels. On the supply side, CMW expects increased demand for infrastructure projects and as a result anticipates that future construction steel prices will trade in a narrow range going forward. This report seems to contradict the declining prices for construction steel reported above. We will continue to monitor and hopefully clarify this and report our findings in future reports.

At Gerdau we keep a keen-eye on Chinese steel production and pricing. China produces close to 50% of the world’s steel and as a result has a massive influence on global steel trade patterns. Imported steel volume and pricing has an influence on domestic steel so we routinely monitor it.