Construction Put-in-Place, (CPIP)

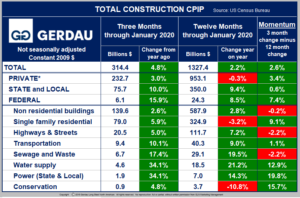

Construction Put-in-Place, (CPIP): Total U.S. construction spending continued to perform well in January 2020, especially in the state and local sector. Census Bureau non-seasonally adjusted (NSA), constant dollar CPIP data showed that January’s twelve month total, (12MT) construction expenditures grew by 4.8% year on year (y/y), to $314.4 billion (B). On a 12MT basis, private expenditures advanced 3.0% y/y, while, State & Local advanced by 10.0% y/y. Non-residential 12MT CPIP increased by 2.6%, 12MT y/y to $139.6B.

Total Construction:

Table 1 presents CPIP data for total construction for both 3 moving total and 12 month moving total y/y metrics. Momentum, defined as 3MT minus 12MT is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 74% of the total three months expenditures ending in December. State & local spending accounted for 24.1%, the remaining 2.0% was for federally financed projects. The private sector posted 3.0% growth and 0.3% decline for 3MT and 12MT y/y comparisons resulting in a positive 3.4% momentum for the month of January.

Single-family residential construction recorded 5.9% increase on a 3MT basis and 3.2% decline on a 12MT basis. On a 3MT basis, State and Local total construction recorded a 10.0% increase in spending.

Non-residential Construction:

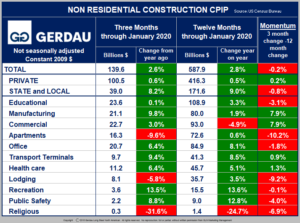

Table 2 shows the breakdown of non-residential construction (NRC). The overall growth rate was 2.6% on a 3MT y/y and 2.8% increase on a 12MT y/y basis resulting in a downward 0.2% momentum.

The growth rate of private NRC was 0.6% for the 3MT, and the rolling 12MT value was 0.5%, leading to a momentum score of 0.2%. State and local expenditures were positive for both 3MT and 12MT metrics.

Economists from the BDC Network comment on the construction segment in 2020, “At this time, it is unclear how coronavirus will affect materials prices, Certain construction components, whether from China or elsewhere, may experience inadequate supply during the weeks ahead, and the more general impact will be decreased input prices due to lower demand.”

At Gerdau we monitor the CPIP numbers every month to keep you, our customers informed on the health of the U.S. construction market.