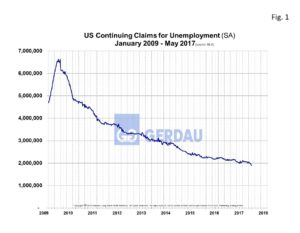

Continuous Unemployment Claims

New data from the Bureau of Labor Statistics (BLS), shows that continuous claims for unemployment benefits fell by 21,000 for the week ending May 6th, this on the heels of the previous weeks 59,000 decline.

Unemployment insurance claims are a count of recipients by state of benefits mandated by federal law. The key advantage of the data is that their extreme timeliness and movements over time can be used to get a grasp of potential movement in the more widely followed employment report from the BLS. Initial claims for unemployment benefits provide a proxy for layoffs, whereas continuing claims give a timely sense of the stock of unemployed workers.

Figure 1 charts SA continuous claims from 2009 to present. Total seasonally adjusted (SA), continuous claims now stand at just 1,899,000, down 273,000 year on year (y/y) and 71% lower than the peak number reached in June 2009. The SA four week moving average for continuous claims fell to 1,946,250. This is the lowest rate since February 1974. This data points to tightening in the labor market.

Figure 1 charts SA continuous claims from 2009 to present. Total seasonally adjusted (SA), continuous claims now stand at just 1,899,000, down 273,000 year on year (y/y) and 71% lower than the peak number reached in June 2009. The SA four week moving average for continuous claims fell to 1,946,250. This is the lowest rate since February 1974. This data points to tightening in the labor market.

The April U.S. Job Openings and Labor Turnover (JOLT), is further evidence that the labor market is tightening. The number of quits is nearly double the number of layoffs. The number of job openings increased to a cyclical high of 6.0 million in April, as the job openings rate was 4.0%. The number of job openings edged up 220,000 in the private sector and increased 39,000 for government. A good number of these open positions won’t be filled since businesses are struggling to find qualified workers. In addition, the U-6 unemployed per open position index fell from 2.5 points in March to 2.3 in April. This value is below the range that is considered full employment.

This data supports the notion that the FED will continue to increase interest rate this rate. Most economists expect at least two hikes, with some forecasting three.

At Gerdau, we keep a keen eye on the employment numbers because we have demonstrated that there is an excellent correlation between employment levels and steel consumption. High job creation and low unemployment translate to strong steel demand and vice versa.