Employment: Initial, Continuous Jobless Claims and Net Job Creation

Seasonally adjusted, (SA) initial claims for unemployment insurance fell by 9,000 to 221,000. The four week moving average (4WMA) was 224,000, 17.0% lower than for the same period last year. Moody’s economist project an unemployment rate of 3.5% by the end of the year as layoffs are low and hiring remains firm.

Continuous claims as well as new claims for unemployment insurance benefits remain near historic lows. Seasonally adjusted (SA), continuous claims stood at 1.940 million, (M) as of January 13th, down 25,000 week on week, (w/w). The SA four week moving 4WMA was a little lower at 1.921M, down 166,500 or 8.0% year on year, (y/y).

Unemployment insurance claims are a count of recipients by state of benefits mandated by federal law. Initial claims for unemployment benefits provide a proxy for layoffs, whereas continuing claims give a timely sense of the stock of unemployed workers.

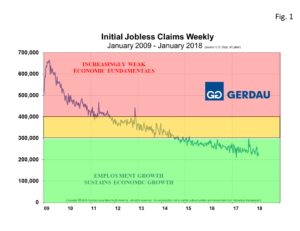

Figure 1, charts SA initial claims for unemployment insurance from 2009 to present. One would have to go all the way back to the early 1970s to find lower numbers. This small level of initial claims is indicative of a labor market that is in very good health.

Figure 1, charts SA initial claims for unemployment insurance from 2009 to present. One would have to go all the way back to the early 1970s to find lower numbers. This small level of initial claims is indicative of a labor market that is in very good health.

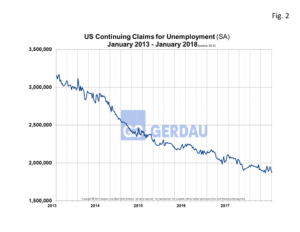

Figure 2  charts SA continuous claims for unemployment from 2013 to present. Continuous claims are at also at historic lows.

charts SA continuous claims for unemployment from 2013 to present. Continuous claims are at also at historic lows.

The insured unemployment rate was unchanged at 1.4% in the week ended January 27th here it has been for several weeks. Just six states reported an increase in NSA new filings in excess of 1,000 in the week ended January 27th.

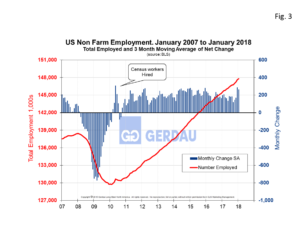

The employment report from the Bureau of Labor Statistics, (BLS) reported that job creation in January totaled 200,000, beating analysts’ expectations, Figure 3. Over the past 12 months ending January 2.269 million, (+1.6%) jobs were created. Goods producing job gains totaled 57,000 for the month and 513,000 for the year, (+2.6%). Service producing job gains totaled 143,000 for the month and 1.756 million for the year, (+1.4%). Note that on a percentage basis, goods producing produced more jobs than service providing. This is a very encouraging sign for manufacturing and construction.

Over the past 12 months ending January 2.269 million, (+1.6%) jobs were created. Goods producing job gains totaled 57,000 for the month and 513,000 for the year, (+2.6%). Service producing job gains totaled 143,000 for the month and 1.756 million for the year, (+1.4%). Note that on a percentage basis, goods producing produced more jobs than service providing. This is a very encouraging sign for manufacturing and construction.

The labor participation was also unchanged, at 62.7%, as was the employment-to-population ratio, at 60.1%.

The BLS Real Earnings report, (adjusted for inflation) from December 2016 to December 2017, real average hourly earnings increased 0.1%, seasonally adjusted. The increase in real average hourly earnings combined with a 0.6% increase in the average workweek resulted in a 0.7% increase in real average weekly earnings over this period.

According to Moody’s economists, core inflation is small and will take several quarters to come to fruition. Therefore, even if wage growth suddenly accelerates, the Fed should not feel any urgency to institute more interest rate increases than the three to four expected this year. Therefore, the labor market can continue to tighten and the immediate risk to inflation will remain fairly small, and the Fed can remain on its current course.

At Gerdau, we keep a keen eye on the employment numbers because we have demonstrated that there is an excellent correlation between employment levels and steel consumption. High job creation and low unemployment translate to strong steel demand and vice versa.