Global Crude Steel Production and Capacity Utilization

Worldsteel Association (WSA) reports that global crude steel production totaled 144.95 million tonnes (Mt) at a capacity utilization rate (CUR) of 72.7% in March. This was a 4.8% year on year (y/y), increase and the highest CUR since December 2015. Global overcapacity continues to be a major concern.

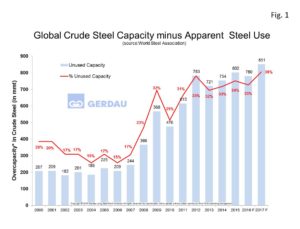

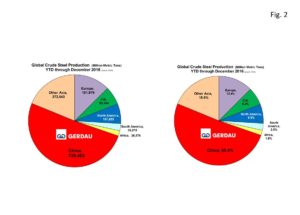

Figure 1 charts global steel overcapacity and percent overcapacity from 2000 to 2016, and includes a WSA forecast for 2017. Some progress was made was made in 2016 as global overcapacity inched down 22 Mt or by 1% to 33% year on year (y/y). However, according to WSA overcapacity will rise 3% to 851 Mt reaching 36% excess capacity in 2017. It is estimated that an additional 94 Mt of new capacity will come online over the year. Of particular concern is China which commands over 50% of global capacity, (Figure 2).

Figure 1 charts global steel overcapacity and percent overcapacity from 2000 to 2016, and includes a WSA forecast for 2017. Some progress was made was made in 2016 as global overcapacity inched down 22 Mt or by 1% to 33% year on year (y/y). However, according to WSA overcapacity will rise 3% to 851 Mt reaching 36% excess capacity in 2017. It is estimated that an additional 94 Mt of new capacity will come online over the year. Of particular concern is China which commands over 50% of global capacity, (Figure 2).  To put this into perspective, in 2016, North America produced 101.5 Mt, accounting for 6.9% of total global production. The US accounts for about 60% of North America production which equates to close to the same volume that China exported in 2016.

To put this into perspective, in 2016, North America produced 101.5 Mt, accounting for 6.9% of total global production. The US accounts for about 60% of North America production which equates to close to the same volume that China exported in 2016.

The Worldsteel Association’s short range outlook projects that 2017 crude steel production will increase by 0.5% to 1,509.6 Mt y/y. It predicts a 2.9% increase for the NAFTA region to 137.4 Mt of which should put US volume at 80.8 Mt. The EU-28 is expected to produce 156.9 Mt, +1.4% y/y, while the rest of Europe is projected to produce 43.7 Mt, an increase of 3.7% y/y. The CIS region looks to bounce back after a decline of 1.4% in 2016 to a positive 2.1% which would be 65.2% of total global production. The Middle Eastern countries are anticipated to be flat a 53.1 Mt, while Africa production is projected to rise 3.9% to 41.1 Mt. Rounding out the world, South and Central America combined are projected to jump 4.1% to 42.5%. This after a 10.4% lower y/y production rate in 2016.

At Gerdau we keep a keen eye on Global crude steel production and capacity utilization because of its huge impact on global trade and its influence on domestic pricing.