Global Crude Steel Production and Capacity Utilization

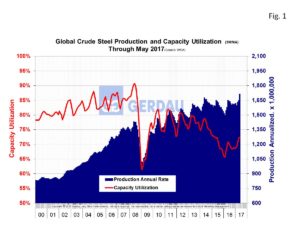

World Steel Association (WSA) reports that global crude steel production totaled 143.325 million tonnes (Mt) at a capacity utilization rate (CUR) of 71.8% in May. This was a 0.5 point increase from last Mays’ 71.3% CUR, but down from Aprils recent high of 73.6%

On a three month moving average (3MMA), basis, the rate of annualized production rate is 1,715.5 Mt. WSA estimates that current global capacity stands at 2,395 Mt, an increase of 48,000 Mt y/y. Subtracting 1,715.5 from 2,395 = 679.5 Mt, which is the excess capacity in the world at current operating rates. This more than five-fold North American annual production.

Figure 1 charts global steel production on the right-hand Y axis and percent CUR on the left-hand Y axis. This current 3MMA rate of 1,715.5 Mt of annualized production passed the previous all-time high set in September 2014. Capacity utilization is trending up thus far in 2017. Despite the welcome increase the CUR, it has a ways to go to reach the 75 to 80% range witnessed in the 2010 to 2014 timeframe and remains far below the 85 to 90% highs experienced during the 2006 to 2008 period.

Figure 1 charts global steel production on the right-hand Y axis and percent CUR on the left-hand Y axis. This current 3MMA rate of 1,715.5 Mt of annualized production passed the previous all-time high set in September 2014. Capacity utilization is trending up thus far in 2017. Despite the welcome increase the CUR, it has a ways to go to reach the 75 to 80% range witnessed in the 2010 to 2014 timeframe and remains far below the 85 to 90% highs experienced during the 2006 to 2008 period.

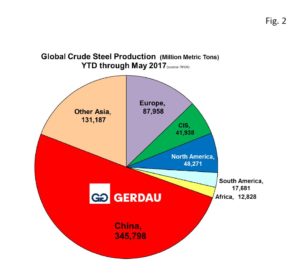

Figure 2 shows a pie chart of raw steel production by region year to date (YTD), through May 2017. China with 345,798 Mt represents more than half, (49.9%, 0.5% lower than YTD 2016), of the total global raw steel output. The next biggest slice is “other Asia” with 131,187 Mt or 19.1% of the global total. Countries in “other Asia” include: India, Japan, South Korea, Pakistan, Taiwan, Thailand and Vietnam. The Europe (EU27), was the next largest producing region YTD with 87,957 Mt, representing 12.8%. The CIS countries (Byelorussia, Kazakhstan, Moldova, Russia, Ukraine and Uzbekistan) combined tonnage was 41,938 Mt YTD for 6.1%. South America accounted for 17,681 Mt, (2.6%) and Africa for 12,828 Mt, (1.9%). North America (which includes Canada, US and Mexico as well as Cuba, El Salvador, Guatemala, Trinidad & Tobago), produced a combined 48,271 Mt for 7.0% of global output. North Americas’ share of global output is currently the same as its 2016 YTD share but up 0.1% over its 2015 YTD share.

shows a pie chart of raw steel production by region year to date (YTD), through May 2017. China with 345,798 Mt represents more than half, (49.9%, 0.5% lower than YTD 2016), of the total global raw steel output. The next biggest slice is “other Asia” with 131,187 Mt or 19.1% of the global total. Countries in “other Asia” include: India, Japan, South Korea, Pakistan, Taiwan, Thailand and Vietnam. The Europe (EU27), was the next largest producing region YTD with 87,957 Mt, representing 12.8%. The CIS countries (Byelorussia, Kazakhstan, Moldova, Russia, Ukraine and Uzbekistan) combined tonnage was 41,938 Mt YTD for 6.1%. South America accounted for 17,681 Mt, (2.6%) and Africa for 12,828 Mt, (1.9%). North America (which includes Canada, US and Mexico as well as Cuba, El Salvador, Guatemala, Trinidad & Tobago), produced a combined 48,271 Mt for 7.0% of global output. North Americas’ share of global output is currently the same as its 2016 YTD share but up 0.1% over its 2015 YTD share.

The Worldsteel Association’s short range outlook projects that 2017 crude steel production will increase by 0.5% to 1,509.6 Mt y/y. It predicts a 2.9% increase for the NAFTA region to 137.4 Mt of which should put US volume at approximately 80.8 Mt.

At Gerdau we keep a keen eye on Global crude steel production and capacity utilization because of its huge impact on global trade and its influence on domestic pricing.