Producer Price Index for Construction

After falling for 24 consecutive month’s year on year, the Producer Price Index (PPI) for all commodities moved up 0.9% year on year (y/y), in December and by 2.4% in January. The material and construction components PPI fared much better than all commodities declining for the first six months of 2016 on a y/y basis before rising for the seven months straight.

After falling for 24 consecutive month’s year on year, the Producer Price Index (PPI) for all commodities moved up 0.9% year on year (y/y), in December and by 2.4% in January. The material and construction components PPI fared much better than all commodities declining for the first six months of 2016 on a y/y basis before rising for the seven months straight.

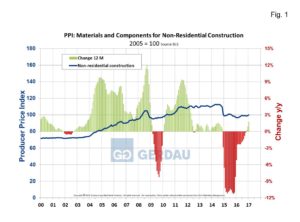

Figure 1 examines the materials and components PPI for non-residential buildings. The index fell sharply starting December 2014 and continued to post double-digit y/y declines from February to November of 2015. The declines moderated in 2016, gradually declining before turning positive in November (+0.3%). December and January also recorded positive growth rising 1.0% and 1.8% respectively.

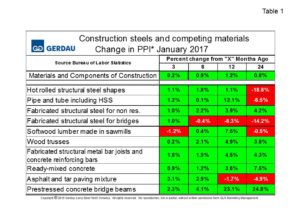

Table 1 presents construction steels and competing materials. The data lists the PPI in percentage change terms referencing time frames 3, 6, 12 and 24 months ago. This tells us whether or not pricing is moving up or down and gives a relative comparison to competing materials. With the exception of softwood lumber (-1.2%), all of the materials in this table have increased in price over the past three months ranging from 0.2% for wood trusses to 3.1% for asphalt and tar paving mixture. Over a 12 month period prestressed concrete beams shot-up by 23.1%. Comparatively fabricated structural steel for bridges fell 6.3% over the same time-frame. This change in relative price should shift a cost advantage in favor of fabricated structural steel. Another example is hot rolled structural steel +1.1%, y/y compared to tube and hollow structural shapes (produced from strip steel), which increased by 12.1% y/y. Once again this should shift material selection in favor of hot rolled structural shapes.

Table 1 presents construction steels and competing materials. The data lists the PPI in percentage change terms referencing time frames 3, 6, 12 and 24 months ago. This tells us whether or not pricing is moving up or down and gives a relative comparison to competing materials. With the exception of softwood lumber (-1.2%), all of the materials in this table have increased in price over the past three months ranging from 0.2% for wood trusses to 3.1% for asphalt and tar paving mixture. Over a 12 month period prestressed concrete beams shot-up by 23.1%. Comparatively fabricated structural steel for bridges fell 6.3% over the same time-frame. This change in relative price should shift a cost advantage in favor of fabricated structural steel. Another example is hot rolled structural steel +1.1%, y/y compared to tube and hollow structural shapes (produced from strip steel), which increased by 12.1% y/y. Once again this should shift material selection in favor of hot rolled structural shapes.

We monitor the PPI which is issued monthly from the Bureau of Labor Statistics because our past analysis has led us to believe that the BLS PPI numbers measure-up to real-world pricing. We feel it is important for us and our customers to know where we are pricing-wise relative to history and how we stack-up against competing materials.