Producer Price Index for Construction

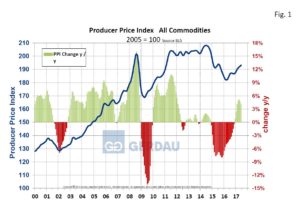

The Bureau of Labor Statistics (BLS), Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. U.S. wholesale prices increased slightly in June but are not rising rapidly, providing further evidence that inflation is well contained. The PPI edged up 0.1% last month, the government said Thursday. The PPI for all commodities came in at 193.2, up 0.4% month on month (m/m) and up 4.2% year on year (y/y), in June. The all commodity index has increased on a three month moving average basis (3MMA), for seven consecutive months.

Figure 1 shows the 3MMA, materials and components PPI for all commodities. The index began declining mid-2014, bottoming-out in March 2016. Since then the trend has been strong to the upside with most econometric indicators pointing to continued higher pricing going forward. The June index 3MMA value was 192.2, up 6.8 points or 4.2% over the past 12 months.

Figure 1 shows the 3MMA, materials and components PPI for all commodities. The index began declining mid-2014, bottoming-out in March 2016. Since then the trend has been strong to the upside with most econometric indicators pointing to continued higher pricing going forward. The June index 3MMA value was 192.2, up 6.8 points or 4.2% over the past 12 months.

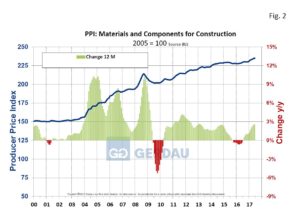

Figure 2 shows the 3MMA, materials and components PPI for construction. The material and construction components PPI recorded a score of 234.4 on a 3MMA basis, up 0.9%, 3 months year on year (y/y). On a 12 months y/y metric, the material and construction components PPI gained 2.6% y/y.

shows the 3MMA, materials and components PPI for construction. The material and construction components PPI recorded a score of 234.4 on a 3MMA basis, up 0.9%, 3 months year on year (y/y). On a 12 months y/y metric, the material and construction components PPI gained 2.6% y/y.

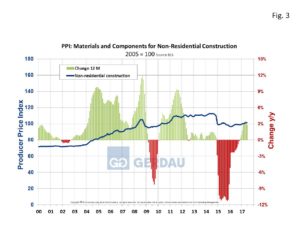

Figure 3 shows the 3MMA, materials and components PPI for non-residential construction. The material and non-residential construction components PPI recorded a score of 101.4 on a 3MMA basis, up 1.1%, 3 months y/y. On a 12 months y/y metric, the PPI gained 2.8%. Inflation for non-residential construction was slightly higher than the all construction materials index, but far less than the all commodities index.

Figure 3 shows the 3MMA, materials and components PPI for non-residential construction. The material and non-residential construction components PPI recorded a score of 101.4 on a 3MMA basis, up 1.1%, 3 months y/y. On a 12 months y/y metric, the PPI gained 2.8%. Inflation for non-residential construction was slightly higher than the all construction materials index, but far less than the all commodities index.

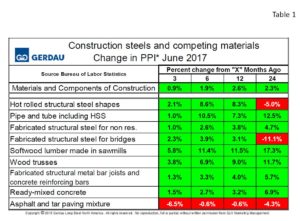

Table 1 presents construction steels and competing materials. The data lists the PPI in percentage change terms referencing timeframes 3, 6, 12 and 24 months ago. This tells us whether or not pricing is moving up or down and gives a relative comparison to competing materials. With the exception of asphalt and paving tar (-6.5% / 3 months & -0.6% / 6 months), all of the materials in this table have increased in price over both the past 3 and 6 month timeframes. Asphalt pricing fell in concert with oil making it more competitive with concrete paving. Softwood lumber has increased the most, up 5.8% over 3 months and up 11.4% y/y. Software lumber prices have been on the rise since countervailing duties on Canadian lumber were awarded in April.

presents construction steels and competing materials. The data lists the PPI in percentage change terms referencing timeframes 3, 6, 12 and 24 months ago. This tells us whether or not pricing is moving up or down and gives a relative comparison to competing materials. With the exception of asphalt and paving tar (-6.5% / 3 months & -0.6% / 6 months), all of the materials in this table have increased in price over both the past 3 and 6 month timeframes. Asphalt pricing fell in concert with oil making it more competitive with concrete paving. Softwood lumber has increased the most, up 5.8% over 3 months and up 11.4% y/y. Software lumber prices have been on the rise since countervailing duties on Canadian lumber were awarded in April.

Steel products including hot rolled structural shapes, pipe and tube are moving-up. Structural shapes were up 2.1% over 3 months and by 8.3% y/y, while pipe, tube and hollow structural shapes recorded increases of 1.0% and 7.3% over the same time references. Fabricated structural steel for non-residential construction and for bridges did not increase as much as the base materials. PPI for these components was up 1.0% and 2.3% over 3 months and 3.8% and 3.1% over 12 months respectfully. Fabricated bar joist and fabricated rebar (grouped together in one category), also increased in price, up 1.3% over 3 months and up 4.0% on a y/y comparison.

At Gerdau, we monitor the PPI which is issued monthly from the Bureau of Labor Statistics because our past analysis has led us to believe that the BLS PPI numbers measure-up to real-world pricing. We feel it is important for us and our customers to know where we are pricing-wise relative to history and how we stack-up against competing materials.