Producer Price Indexes of Steel & Competing Materials

The Producer Price Index (PPI) is a weighted index of prices measured at the wholesale, or producer level. A monthly release from the Bureau of Labor Statistics (BLS), the PPI shows trends within the wholesale markets, manufacturing industries and commodities markets.

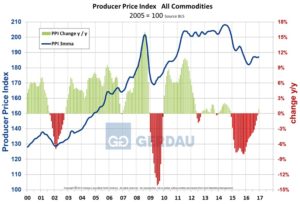

[caption id="attachment_1064" align="alignleft" width="500"] Figure 1[/caption]

Figure 1[/caption]

Figure 1 presents a historic review of all commodities from 2000 to present. Prices have largely plateaued for the past six months on a 3MMA y/y basis after rising through the middle of 2016. When examined on a y/y basis in percentage terms, overall commodity prices finally posted a gain of 0.9% after declining for 24 consecutive months.

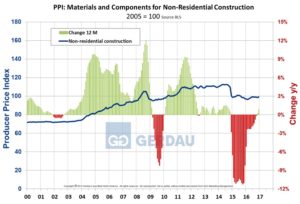

The non-residential construction PPI has been fairly flat for the past two years after a significant drop in 2015. Year on year percentage has been positive for two months after 24 months of declines, (Figure 2).

[caption id="attachment_1066" align="alignright" width="500"] Figure 2[/caption]

Figure 2[/caption]

Table 1 presents construction steels and competing materials referencing 3, 6, 12 and 24 months ago. The PPI for hot rolled structural steel shapes was down 3.2% y/y ending December, while pipe and tube including hollow structural shapes (HSS) was up 9.0% over the same time-frame. Compared to 3 months ago, structural steel shapes was down 0.6% as HSS declined by 4.1%.

Fabricators making structural steel parts for non-residential construction projects have been able to increase prices in each of the last four time references. This has not been the case for fabricators that produce steel bridge components. These fabricators have seen prices decline for each of the four time-frame comparisons. Meanwhile pre-stressed concrete bridge beams have seen strong price increases indicating a strong demand for this product. The resultant differential with bridge structural steel should translate into a cost advantage for steel. Wood and ready-mix concrete have enjoyed steady price increases as demand for housing continues to recover. However, the most recent 3 month time comparison are much smaller; +0.5% for ready-mix and down 2.1% for softwood lumber. Asphalt paving mixture has seen price declines due to the decline in petroleum pricing. For the 6 month comparison asphalt and tar paving mixtures have witnessed a price decline of 12.1%.

Figure 3 presents the PPI of hot rolled bars from 2010 to present. The price fell throughout 2015 before cycling up and back down in 2016. The index has now been up for two months in a row, however on a 12 month y/y percentage basis, it has recorded negative values for 24 consecutive months. The good news is that the month over month decline is moderating.