U.S. Housing Inventory and Prices

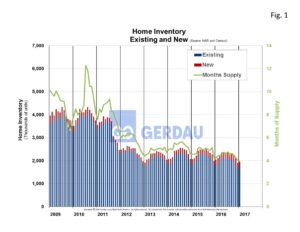

Housing inventory level of existing homes fell to 3.6 months’ supply in January, the lowest level since 2005 when it averaged 4.5 months’ supply for the year. New home inventory was 6.4 months’ supply, so the total supply was 4.0 months (January), very low by historic standards. Low supply coupled with low interest rates is a recipe for higher prices. According to Census Bureau data, the national median price of home sales including land rose 7.5% year on year to $312,900 in January. Interestingly the average price fell 1.3% to $360,900 over the same time comparison.

Housing inventory level of existing homes fell to 3.6 months’ supply in January, the lowest level since 2005 when it averaged 4.5 months’ supply for the year. New home inventory was 6.4 months’ supply, so the total supply was 4.0 months (January), very low by historic standards. Low supply coupled with low interest rates is a recipe for higher prices. According to Census Bureau data, the national median price of home sales including land rose 7.5% year on year to $312,900 in January. Interestingly the average price fell 1.3% to $360,900 over the same time comparison.

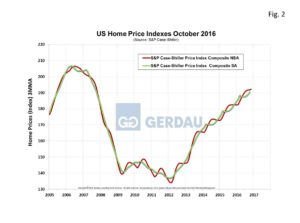

Figure 1 shows inventory of new and existing houses from 2009 to present. The old “rule of thumb” was that builders accelerate construction of new homes when inventory falls below six month’s supply. This rule does not seem to apply any longer as inventories have not been north of six months since mid-2011.  Figure 2 presents the three month moving average of the Case-Shuler home price index from 2005 to present in both seasonally adjusted and non-seasonally adjusted configurations. After the great recession ended in 2009, home prices continued to drift lower before staging a turn-a-round beginning Q2-2012. Since the low point in March 2012, CSA Index = 124.07 NSA, prices have increased by 43% reaching CSA = 192.14 NSA in November.

Figure 2 presents the three month moving average of the Case-Shuler home price index from 2005 to present in both seasonally adjusted and non-seasonally adjusted configurations. After the great recession ended in 2009, home prices continued to drift lower before staging a turn-a-round beginning Q2-2012. Since the low point in March 2012, CSA Index = 124.07 NSA, prices have increased by 43% reaching CSA = 192.14 NSA in November.

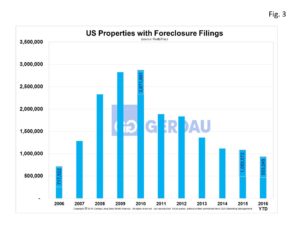

Foreclosures fell 13.9% in 2016 year on year to 933,045 units, the first time under one million since 2006. Mortgage rate which have accelerated over the past few months hasn’t damped sales or caused a rise in foreclosure activity thus far. It is probable that interest rates will move higher which will likely impact sales and increase the foreclosure rate going forward, (Figure 3).

At Gerdau, we monitor the US housing market because historically new home construction has preceded non-residential construction (NRC), and therefore is an excellent barometer to foresee future demand for NCR.

At Gerdau, we monitor the US housing market because historically new home construction has preceded non-residential construction (NRC), and therefore is an excellent barometer to foresee future demand for NCR.