U.S. Steel Capacity Utilization

Raw steel production for the week ending July 22nd, 2017 was 1.773 tons at capacity utilization of 76.1%, its highest levels since June 2016. The most recent four week capacity utilization rate edged-up to 74.9% at an average production rate pf 1.747M tons per week. Year to date (YTD), US steel production averaged 1.736 million (M), tons per week at an average capacity utilization rate of 73.9%.

Figure 1 shows production on the left-hand scale and capacity utilization as a percent on the right-hand scale. Production and capacity utilization have been moving steadily higher thus far in 2017 after drifting lower through the latter half of 2016. Domestic producers have been able to increase production levels as import volume has plunged since the section 232 investigation was launced.

Figure 1 shows production on the left-hand scale and capacity utilization as a percent on the right-hand scale. Production and capacity utilization have been moving steadily higher thus far in 2017 after drifting lower through the latter half of 2016. Domestic producers have been able to increase production levels as import volume has plunged since the section 232 investigation was launced.

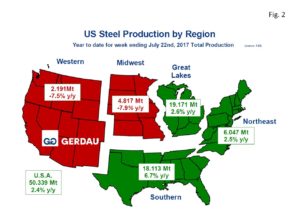

Figure 2  presents a map of the US with the five steel producing zones. The Great Lakes produced the most steel, with 19.171 million tons (Mt), up 2.6% YTD y/y. The Southern region produced 18.173 Mt, up 6.7% YTD y/y. With 6.047 Mt, the Northeast tonnage increased by 2.5% y/y. The Midwest and Western zones both produced less steel YTD compared to the same timeframe a year ago. The Midwest produced 4.817 Mt off 7.9% YTD y/y, while the West produced 2.191 Mt down 7.5% y/y.

presents a map of the US with the five steel producing zones. The Great Lakes produced the most steel, with 19.171 million tons (Mt), up 2.6% YTD y/y. The Southern region produced 18.173 Mt, up 6.7% YTD y/y. With 6.047 Mt, the Northeast tonnage increased by 2.5% y/y. The Midwest and Western zones both produced less steel YTD compared to the same timeframe a year ago. The Midwest produced 4.817 Mt off 7.9% YTD y/y, while the West produced 2.191 Mt down 7.5% y/y.

Looking at the data on a more recent 3 month moving total (3MMT), y/y basis, presents a different picture. Nationally the 3MMT y/y was flat at +0.1% y/y. The strongest percentage growth was the Northeast at +2.6%, followed by the Southern zone, up 1.4%. The other three regions posted declines: Western zone -1.3%, 3MMT y/y, followed by the Midwest -1.1% and the Great Lakes with -1.4% less volume 3MMT y/y.

Momentum (3MMT minus 12MMT), was positive in all regions except the Great Lakes (-2.2%). Nationwide momentum was +3.7%. The Midwest had the strongest momentum with +13.2%, followed by the West at +6.7%. The Northeast came-in at +6.3% and the South at +2.5%. Overall the latest capacity utilization report was encouraging trend.

At Gerdau, we track US steel production and capacity utilization to keep an eye on the overall health of the US steel industry. We feel it is important to understand the forces that influence steel demand to include the strength of the US economy and import penetration.